All published articles of this journal are available on ScienceDirect.

Mediating Role of Acculturation on Newcomer Employees Behavior and Performance of Mergers and Acquisitions Process: An Empirical Analysis of Indian Banking Sector

Abstract

Introduction:

New ways of structuring, adopting new technology, and reshaping the role and responsibility in the banking operation have impacted the working conditions as well as the daily lives of bank employees. Acculturation is an emerging concept that may influence the short and long-term success or failure of any organization. Acculturation is firmly connected to Mergers & Acquisitions (M&A) performance because it affects the banking sector’s business value and should be addressed after the merger.

Methods:

The current study is an attempt to examine the association between newcomer employee behavior and the performance of the M&A process, as well as the mediating effect of acculturation in this relationship. The sample size constitutes 303 newcomers banking employees who have joined the four acquired public sector banks after the mega-merger of six public sector undertaking banks on 1st April 2020. The research paper used CFA to examine the constructs' reliability and validity and used PLS-SEM to test the research hypotheses.

Results:

According to the statistical findings, new employee behavior and mergers and acquisitions performance were found to be significantly related at p-value < 0.001. Subsequently, acculturation mediates the relationship between newly joined employee conduct and large M&A performance.

Conclusion:

When a firm goes through the mergers and acquisitions process, they learn that cultural indigestion is a critical issue that influences employee behavior during the M&A process, which is often overlooked by senior management. The study finds out the post-merger problems and failures in the banking industry as a result of organizational culture differences.

1. INTRODUCTION

The health of the banking system is a significant segment that strengthens a country's economic growth and development and allows it to achieve self-sufficiency in an ever-changing business environment and protect them from collapsing in a vulnerable situation. The downfall of the banking industry in any country can trigger a financial crisis. Excessive lending at subpar rates, substantial weaknesses in the prudential framework, reckless risk-taking, insufficient capital, and a lack of liquidity reserve are all examples of the crisis in the banking industry [1]. As the financial sector moves toward globalization and deregulation, it undergoes a series of significant structural (Banking Business model) and functional changes (new operating landscape) [2, 3]. In today's world, when the globe is more dynamic, growth is the yardstick for surviving the cutthroat competition, and banks have chosen a variety of techniques to maintain a structured and steady rise on the global stage [4]. One such approach is through the process of consolidation of banks, which emerged as one of the most profitable strategies in terms of both achieving operational efficiency in the form of the economics of scale and scope as well as financial performance [5]. The most often used approach to synthesize the banking business is mergers and acquisitions [6]. There is no doubt a successful merger and acquisition can bring value to the acquirer as well as to the acquired organization. In banking, mergers and acquisitions are mostly used weapons when growth strategies are discussed and implemented [7]. Despite this idealism, previous research showed that many of these banks end up with high failure rates among M&A. By taking a close look, one of the principal causes often seen on the top for M&A failure, i.e., clash of corporate culture, be it in domestic alliance or international M&A in the banking sector [8]. In the majority of M&A scenarios, the operating model and culture will undergo significant change for one or both merging identities. Large-scale integration does entail some short-term challenges if much importance is not given to the acculturation of the two merged organizations [9]. To succeed and achieve their corporate goals, it is important to manage cultural differences between the acquirer and the acquired after the merger, even though they both are in the same industry [10].

1.1. Mergers in the Indian Banking Sector

Chronologically, Mergers & acquisitions (M&A) of PSBs in India can be divided into five phases. In the year 1993-1994, PNB acquired New Bank of India to safeguard the interest of various stakeholders as it was suffering from loss; this was the first-ever merger in the Indian banking sector. In 2008 SBI acquired one of its associates, i.e., State Bank of Saurashtra, as it was smaller than other associates. The merger intended to build achievement at the global level. In April 2017, five SBI associates along with Bharatiya Mahila Bank Ltd. (BMB), merged with the State Bank of India (SBI). With this merger, SBI held the position of the national championship among Indian banks in terms of largest lender and entered the top 50 global banks in terms of assets. With effect from 1st April 2019, two nationalized banks Vijaya Bank and Dena Bank, were merged with Bank of Baroda (BOB). As a result, BOB became India's second-largest PSBs [2].

On 1st April 2020, despite the national lockdown in the country due to the pandemic, the government of India announced that six public sector undertakings (PSU) banks will be merged into four enormous public sector banks in a bid to build them universally competitive. This was the biggest ever merger of the public sector banks in India, prominently considered a mega-merger of PSBs. This mega-merger reduced the no. of public sector banks from 27 PSUs to 12. Now, in India, with effect from 1st April 2020, six merged and six independent PSUs are in work.

1.2. Acculturation and its Relationship with Mergers & Acquisitions

Acculturation is a phenomenon that begins when an individual comes into contact with ethnically diverse cultural groups and their members; firstly, he/she experiences various behavioral and psychological changes due to changes in one or both group’s cultures, and subsequently, he/she would find a balance and develop culture maintenance [11]. Intercultural adoption requires cultural adjustment and acculturation. For this, the individual needs to apply self-adaptive skills and successfully explore the expertise to get an insight into the new environment [11, 12]. Diverse cultural perspectives allow an organization to perform better work outcomes by offering a broader assortment of products and services, skills in a base multicultural workforce for an enriching experience, enhanced effective marketing strategy, and sound quality decisions to expand into new markets [13]. Employees with curiosity and openness can handle two different cultures and overcome the challenges of adjustment. They are connected with high psychological adaptation and an inspirational outlook in which the individual can embrace the new climate [14]. Then again, a few researchers confirm that the appearance of multi-culture in an organization has an unfavorable impact [15] on employee conduct like unreasonable substantiation in employee turnover [16], job change [17], work-related anxiety [18], and wave of insecurity [19]. The main challenges the employees face are the organization’s identity, its new structures, governance, and day-to-day work [20]. Even small tactical changes, like new appraisals or compensation & benefits, can disconcert employees [21].

Generally, the employees are change-resistant and the cultural incompatibilities cause organizational problems. At the point when two independent associations merge into one, cultural homogeneity is lost [22]. Organizational culture mismatch is the most common cause of organizational conflict and M&A failure. Prior studies have broadly identified the organizational behavior, organizational factors, and specific employee traits that account for employees' resistance to organizational change during the M&A process [23, 24]. Some studies emphasize employees' personal qualities of mindfulness [25-27]. The quality of mindfulness allows people to improve their own physical and mental health [28, 29]. Additionally, some research concentrated on optimism, resilience, and self-efficacy as individual traits [30]. It has been found that bicultural individuals are exceptionally connected with positive perspectives toward two distinct cultural identities, and in such individuals, both cultures are flourishing.

Lesser attention has been received on human resource management, sociology, and psychological diagnoses approach during the process of M& A. Cultural clashes are often attributed to human resource and performance issues in M&As. Stress from acculturation is a significant impediment to strategic change [31]. The research paper tries to concentrate on how the new employees of an acquired firm perceive acculturation and acculturative stress. Due to culture clash, the process of productive restructuring (M&A) has an impact not only on the banking environment but also on employee health in the form of increasing strain, tension, and meeting deadlines, leading to job discontent and psychological complaints that eventually lead to cognitive anxiety and health complaints [32]. Failing to anticipate and address them can lead to poor business performance, a loss of critical talent, and the leakage of synergies [33]. Employee turnover and employee resistance are commonly mentioned problems on the “human side” that can complicate the achievement of strategic goals of the M&A [34]. Unless a perfect “marriage of business cultures” is achieved, mergers can end up as an expensive failure. Subsequently, the firm that has a similar strategy in terms of organization sharing, hierarchical culture, administration styles, and authoritative processes is characterized as a viable association fit and is asset proficient attributable to quicker coordination and correspondence as authoritative individuals share comparable convictions [13, 21].

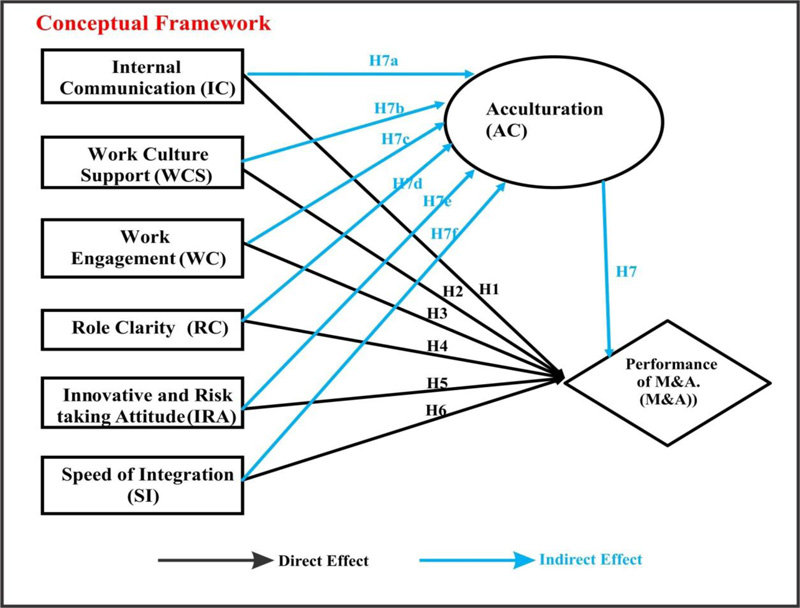

Hence, the study aims to examine the association between newcomer employee behavior and the performance of the M&A process as well as to explore the mediating effect of acculturation in this relationship.

2. THEORETICAL FRAMEWORK AND ANTECE-DENTS OF ACCULTURATION AND M&A

The Synergy Theory advocates the amount of economic benefit and economics of scale as a rationale behind the mergers [35]. The theory suggests that in the merger, the sound financial banks want to merge with the passive banks to improve profitability that spurs internal growth and to avoid failures in the dynamic competitive advantage [32]. As a result, the main bank (acquirer bank) has more customers and both banks (acquirer and acquired bank) will have more income.

Synergies are supposed to bring as a result of M&As. Synergy theory is likely to lead to more extensive use of already available resources [36]. The result demonstrates that the more inputs that can be shared within the new organization, the larger the likelihood of M&A increase. Problems occur when synergies are put from thought to action. One of the reasons is to focus too much on tangible aspects, the financials and the rationales of the deal, and too little on the soft sides of the integration as well as interpretations of cultures and systems [37]. Management is involved in the overall plans and the strategic changes; however, it is the organization’s people, the employees, who will make the changes work in reality. If the employees are not satisfied, synergy realization problems arise [38].

The Market Power Theory suggested uncompetitive high profits by increasing the number of a firm’s resources [16, 17, 39]. The theory offers the pragmatic approach to M&A in the banking sector prompted productive restructuring that improved resource allocation efficiency, reduced financial intermediation costs, increased free competition among banks both locally and globally, and brought down the inflationary spiral [40]. Internal banking mergers and acquisitions in Italy have been motivated by a strategic goal of reorganization as opposed to monetary disappointments [41]. As a result, these mergers and acquisitions not only assist in modulating the terrain of banks but also modify the landscape of banking.

Market power theory is related to higher margins achieved through increased negotiation capabilities toward suppliers and customers. Competitive advantages can be gained or strengthened through increased focus on core capabilities and niche areas [42]. Though the reasons for M&As should always be to improve the organization’s performance, sometimes M&A affects the organization negatively by increasing the workload of employees that occur to capacity constraints [43]. Therefore, these high job demands can create tremendous stress among employees that can cause them to experience emotional exhaustion [44]. Hence, the company cannot take advantage of an opportunity, such as a temporarily excess in demand. The outcome shows that capacity constraints occur in slack resources, which further restrict the possibilities for enhancements in the organization. Therefore, the following hypotheses have been proposed.

2.1. H1: Internal Communication will have a Positive Association with the Performance of Mergers and Acquisitions

The hypothesis supports communication theory by outlining the knowledge gap and justifying the significance of various forms of communication in mergers and acquisitions. Immediate, effective, and interactive communication strategy plays an important role in the M&A process and it is vitally important to choose the channel in a sensitive manner through which communications are delivered [45]. Lack of communication can lead to merger syndrome [46]. Internal communication is one of the most coordinating activities, 84% of Finnish companies tried to improve their internal communication for further deals in M&A because the target company employees are likely to embrace the new organizational norms, new corporate culture, and management structure and create a vision regarding the new operating system [47]. Poor communication sometimes creates the problem of discontent among the employee that can occur passive resistance and negative behavior [48]. Developing a good relationship between the organization and its employee's internal communication was identified as one of the most important reasons for the development. Effective organizational communication during M&A reduces uncertainty, helps the organization in the transition, increases post-acquisition commitment to the “new” organization, and increases M&A success rates [49]. Additionally, it supports workers in managing various distressing emotions and minimizing disruption during the merger process.

2.2. H2: Work Culture Support towards the Organization will Influence the Performance of M&A Positively

Strategic, economic, or financial factors seem insufficient while understanding the phenomena of M&A. The reasons for M&A failure are the less association among the employees within the acquiring or merging organizations and the way the organization deals with and responds to this matter [50]. There is a widespread feeling among the employees that M&A are disruptive activities generally related to structural changes, changes in work practices, cultures & values differences, and general feelings of uncertainty and tension [51]. The acquired firm has received special attention because the M&A process may cause it to lose its corporate identity as a result of the combination of both human and physical assets [52]. To improve leaders' behavior, performance, and work of their subordinates in pursuit of the satisfaction of their clients, good organizational structures and culture serve as mediators. Supporting a work culture that prioritizes people, clients, and action is essential to excellence [53]. Managerial autonomy can affect the acquired firm's decision to stay or leave during the M&A process. The removal of autonomy can make the acquired company's executives feel inferior to the executives of the acquiring company, or it can make the acquiring company executives think they are better [54]. Thus, preserving the relative balance of the acquired company's executives motivates and controls the operation of the organization.

2.3. H3: Tendency of Work Engagement will have a Significant Positive Association with the Performance of M&A

Work engagement is a concept that has connections to cognition, affect, and behavior. Engagement provides a positive perspective on employee presence; it shows how people and organizations view their potential rather than concentrating on their weaknesses [55]. Furthermore, it has been discovered that those who are engaged are happier than those who are not [56]. Giving the feeling of involvement among the employees is a good way to create a tenderness of excitement and develop a good relationship of trust & security [57]. M&A involves the management of cultural differences in the organization that can be dealt with by successful handling of the transaction or the existence of charismatic leadership [58]. To create work culture support and establish a healthy link, include social acculturation among teams through induction programs, social get-togethers, and temporary worker rotations [59].

2.4. H4: Role Clarity at the Workplace will Influence the Performance of M&A Positively

It has been found in the banking sector that higher role conflicts create a lower level of job satisfaction and bring role ambiguity. Role conflict occurs when different and incompatible roles are assigned simultaneously, which does not match the employee's skills, causing greater anxiety and work-related stress and reducing employee productivity [60, 61]. Role ambiguity creates the absence of clarity regarding the roles among employees and is considered one of the major bottlenecks in team performance. Role clarity creates when the employees know what is expected with their assigned task, then they tend to perform better [62]. Role clarity at work encouraged socio-psychological adaptation among various groups and gave people the chance to build their identities by joining a significant reference group in their workplace and maintaining or developing their professional identity [63].

2.5. H5: Tendency of Innovation and Risk-taking Attitude will have a Significant Positive Association with the Performance of M&A

Innovation is recognized as the main strategic driving force that leads to an organization's competitive strategy development [64]. It reduces high transaction costs related to the transmission of knowledge between firms. Mergers and Acquisitions create a new business environment, which is the key success factor of innovation. Overseas M&A can enhance a company’s innovative capability and innovative thinking and promote innovation-driven development [65]. M&A can enable enterprises to quickly acquire high levels of expertise, and obtain complementary R& D resources, experienced employees, and technological paradigms to meet the challenges of a dynamic and competitive environment. Many studies showed that the innovation efficiency of state-owned enterprises (SOEs) is significantly lower than that of foreign-funded and private enterprises [66]. Good corporate culture helps the employees to use his /her creativity, talents, and skills in the workplace, which ultimately leads to employee identity and stability, providing risk-taking ability [67].

2.6. H6: Speed of Integration will Influence the Performance of M&A Positively

M&A in the banking sector often necessitates the merger of language and communication, which must be accommodated with a better plan to better govern it and stimulate the speed of integration [68]. It has been discovered that faster task integration degrades integration performance in the short term, whereas faster human integration improves performance. Good corporate culture provides employee identity and stability, which in turn provides work engagement [69]. According to several authors, integration speed can positively impact the success of M&As. Implementing an effective integration plan is beneficial because it reduces the potential for uncertainties and facilitates the fast integration of two entities into a single, synergized unit [70]. The effective integration approach covers the culture, processes, operations, and identity.

2.7. H7: Acculturation Positively Mediates the Relationship between

- H7a: Internal Communication;

- H7b: Work Culture Support;

- H7c: Work Engagement ;

- H7d: Role Clarity;

- H7e: Innovative & Risk-taking Attitude; and

- H7f: Speed of Integration and M&A performance

Acculturation is the process by which newcomer workers become more comfortable in their new environment by becoming familiar with the local customs and culture, learning the language, and gaining experience with work-related norms and practices [71]. Acculturation improves communication and performance by lowering uncertainty, intergroup anxiety, intercultural communication trepidation, and identity gaps in both the individual and their relationships [72]. Acculturation aids new hires in comprehending cultural exposure, mentoring, and training. Acculturation makes it easier to understand a new culture's fundamental rules, learn the proper work values, expectations, and standards, and improve the quality of interpersonal relationships with locals in the host country, all of which improve employee performance [73]. Acculturation establishes the foundation of an individual's self-motivations or self-concept of improvement, efficacy, and consistency that inspires employees to learn about and have the confidence to deal with new cultural circumstances. With cultural intelligence as a mediating factor, the employees foster higher psychiatric attunement diversity in their attitude and response towards diversity, reducing cognitive complications [74]. Undoubtedly, the increasing number of bicultural individuals around the world contributes to better implementation in any work environment. The present study proposes an acculturation strategy that will mediate the new employee’s behavior with the performance of mergers and acquisitions in the Indian banking context.

3. RESEARCH METHODOLOGY

Acculturation can be elucidated from two outlooks one is at the collective level, i.e., (from the point of view of the merged entity in the banking sector) and the second is at the individual level, i.e., (from the point of view of employees). The present study focused on the individual level, considering bank employees who worked in an acquiring firm and had just arrived in the acquired firm under the process of M&A. Earlier, they had not been associated with this acquired firm and now they recently become a member of a group other than the original group [75] considering as newcomers or new representatives in the banking sector [49]. Most empirical studies used the term “new” based on the tenure of their services rendered after they entered the merged entity. Subsequently, the employees who served the initial nine months or achieved one year of work in the merged entity are considered new representatives [76]. New representatives have been appraised as a subgroup of total representatives.

3.1. Data Collection

The present study considered the same criterion to include newcomers employees as the respondent who has connected with the merged entity for not less than 6 months and not more than 12 months. For this, the researcher selected the newcomer employees of four public sector banks (PNB, Canara Bank, Union Bank of India, and Indian Bank) who perceived and consummated the whole procedure of M&A from 1st April 2020 onwards. The sample of the respondents was collected from the Northern India State working in the branches of four acquired banks. The employees belonging to different departments and different management cadres in the banking sector were selected. The ratio of male and female respondents was taken 40% and 60% for the study.

A convenience sampling method was adopted to collect the data. The researcher had a preliminary dialogue with the top-level management of the acquired banks to recognize the staff who encountered the inclusion benchmark. The respondents were selected randomly, and in total, 320 five-point Likert scale questionnaires were distributed ranging from1 (strongly disagree) to 5 (strongly agree). Out of 320 questionnaires, five respondents did not return and twelve respondents filled out less than 80 percent of the questionnaires. So the total number of respondents (newcomer employees) used in the study was 303, representing an approximately 94% response rate. The techniques used in the present study for data analysis were appropriate in terms of sample size [77].

3.2. Research Design

The present study used a descriptive research design. Acculturation is a mediating variable in the proposed model. A mediation test was conducted to discover that the acculturation measurement construct appreciable to hold the capacity of an exogenous variable (Newcomers employee behavior) to an endogenous variable (performance). Correspondingly the mediation test regulates the indirect effect of exogenous variables on the endogenous variable through a mediating variable. Statistical tests such as CFA and SEM only accept responses from a 5-point scale or above. The methodology for the data analysis was carried out in two stages. In the initial step, the researcher used confirmatory factor analysis to establish the factor construction of measurement scale items in terms of validity, reliability, and model fit. The subsequent step examined the path (arrow) relationship between the constructs of the proposed model and its hypotheses.

4. RESULTS

For extracting the factors, confirmatory factor analysis (CFA) was performed to validate the factors. After validating the factors, the next step was to test the proposed hypotheses. To test the hypotheses, the Structural Equation Modeling (SEM) technique was applied.

5. CONSTRUCT MEASUREMENTS

To enhance the validity of the proposed model (Fig. 1), the researcher relies on the existing scales of the construct measurement, which were already available in the literature review, to form the survey questions. The measurement of independent variables Internal Communication was adopted from a study [78], work Culture Support was measured with items of scales [79], the items of work engagement were derived directly from another study [80], role clarity was adopted [81], innovation and risk-taking attitude were measured by four self-reported items [82], and : speed of integration was measured with the items of scales based on a study [83]. The construct of the dependent variable (performance of M&A) was adopted from the literature [84]. A little contextual adjustment was done to the scale items to make them tailored to fit the environment of the current examination and the path (arrow) revealed the association between the latent variables and dependent variables. In the present study, the items-to-response ratio is 1:11, which is acceptable according to the recommendations [85] that the item-to-response ratio should be more than 1:4.

5.1. Confirmatory Factor Analysis

Confirmatory factor analysis is a multivariate statistical approach commonly applied to estimate the validity of the construct. To check the reliability and validity of the constructs, CFA was applied to the items of the constructs to test how well the model is statistically fit. (Table 1) showed the summarized results for the loadings of the items. One item of WCS1 from Work Culture Support was eliminated due to low factor loadings. All other factors loaded were significant and acceptable. The composite reliability of the measurement constructs ranges from 0.902 and 0.0945. These thresholds exceed the least acceptable yardstick for composite reliability, i.e., 0.7. Hence internal consistency reliability was achieved. The minimum acceptable threshold for average variance extracted (AVE) is 0.4. The results of the current study show that both (AVE > 0.5 on all occasions) and (CR > 0.7 on all occasions) transcend the standard.

| Variables | Items | Standardized Estimate | Standard Error | Critical Ratio | Average Variance Extracted | Composite Reliability |

|---|---|---|---|---|---|---|

| Internal Communication (IC) | IC1 | 0.669 | ||||

| Mean=4.33 | IC2 | 0.894 | 0.143 | 11.269 | 0.686 | 0.915 |

| Std.dev=0.55 | IC3 | 0.905 | 0.142 | 11.32 | ||

| Work Culture Support (WCS) | WCS2 | 0.778 | ||||

| Mean=3.66 | WCS3 | 0.816 | 0.065 | 16.796 | 0.594 | 0.88 |

| Std.dev=0.75 | WCS4 | 0.734 | 0.071 | 14.869 | ||

| WCS5 | 0.75 | 0.072 | 15.252 | |||

| WCS6 | 0.773 | 0.069 | 15.802 | |||

| Work Engagement (WE) | WE1 | 0.799 | ||||

| Mean=4.20 | WE2 | 0.551 | 0.143 | 8.658 | ||

| Std.dev=0.69 | WE3 | 0.708 | 0.126 | 9.996 | 0.529 | 0.914 |

| WE4 | 0.994 | 0.161 | 11.563 | |||

| WE5 | 0.654 | 0.134 | 9.584 | |||

| Role Clarity (RC) | RC 1 | 0.525 | ||||

| Mean=3.68 | RC 2 | 0.624 | 0.112 | 9.574 | 0.614 | 0.882 |

| Std.dev=0.84 | RC 3 | 0.689 | 0.126 | 10.146 | ||

| RC 4 | 0.986 | 0.149 | 12.006 | |||

| Innovative and Risk-taking Attitude (IRA) | IRA1 | 0.688 | ||||

| Mean=4.13 | IRA2 | 0.787 | 0.078 | 14.188 | 0.629 | 0.824 |

| Std.dev=0.77 | IRA3 | 0.897 | 0.081 | 15.823 | ||

| Speed of Integration (SI) | SI1 | 0.654 | 0.134 | 9.584 | ||

| Mean=3.68 | SI2 | 0.624 | 0.112 | 9.574 | 0.614 | 0.882 |

| Std.dev=0.84 | SI3 | 0.689 | 0.126 | 10.146 | ||

| Acculturation | AC1 | 0.688 | ||||

| Mean=4.13 | AC2 | 0.787 | 0.078 | 14.188 | 0.629 | 0.824 |

| Std.dev=0.77 | AC3 | 0.897 | 0.081 | 15.823 | ||

| Merger & Acquisition | MA1 | 0.91 | ||||

| Mean=4.13 | MA2 | 0.9 | 0.091 | 15.577 | 0.9.05 | 0.708 |

| Std.dev=0.77 | MA3 | 0.62 | 0.095 | 15.433 |

5.2. Discriminant Validity

Table 2 shows the discriminant validity. It represents the correlation matrix results that address the relationship framework between the measurement constructs of the proposed model. The latent variable correlation between the constructs represented in the off – diagonals cells and the square root of the AVE are shown in the diagonal cells. Results show that the diagonal value is higher than the off-diagonal values in the corresponding rows and columns. The diagonal values (the square root of AVE) of each construct in Table 2 are all greater than their respective off-diagonal values, indicating adequate discriminant validity.

6. STRUCTURE MODEL

6.1. Hypotheses Verification (Direct)

Table 3 depicts the outcome of the perfectly-fitted model and clarifies the immediate relationship between independent (exogenous) and dependent (endogenous) variables. Among six independent variables based on newcomer employee behavior, five variables, i.e., internal communication, work culture support, work engagement, role clarity, and speed of integration, were positively and substantially direct linked with the performance of M&A. Therefore, hypotheses H1, H2, H3, H4, and H6 were accepted and empirically supported the study. Additionally, the results of SEM revealed that innovation and risk-taking attitudes among newcomers employees have no significant relationship with the performance of M&A and were found to have an inconsiderable interdependence on M&A performance in the Indian banking industry. Hence, H5 was rejected. All constructs are significant at a 0.05% level of significance.

6.2. Hypotheses Verification (Mediation)

Table 4 used VAF to recognize the indirect magnitude effect regarding the total effect. It also verified the mediating effects at two different levels on six independent (exogenous) constructs considered in the proposed study. Firstly the relationship between information communication, work culture support, work engagement, role clarity, and speed of integration with the performance of M&A has partially mediated through acculturation. Thus H7-a, H7-b, H7-c, H7-d, and H7-f are supported and accepted. Secondly, an innovative and risk-taking attitude has an indirect mediation effect on M &A through Acculturation (AC) and supports H7-e. The present study showed that there is no direct and significant relationship between innovation & risk-taking attitude with the performance of M&A, and insignificant contributions exist between them. While its indirect relationship is significant, the mediating role of AC proved this argument as it mediates the effect of IRA on the performance of M&A and makes it highly significant (H7-e). It shows that acculturation (Mediation) exists between IRA and the performance of M&A.

| Internal Communication | Work Culture Support | Work Engagement | Role Clarity | Innovative and Risk-taking Attitude | Speed of Integration | Acculturation | Merger & Acquisition | |

|---|---|---|---|---|---|---|---|---|

| Internal Communication | 0.828 | - | - | - | - | - | - | - |

| Work Culture Support | .311** | 0.770 | - | - | - | - | - | - |

| Work Engagement | .537** | .217** | 0.727 | - | - | - | - | - |

| Role Clarity | .280** | .390** | .203** | 0.783 | - | - | - | - |

| Innovative and Risk-taking Attitude | .189** | .219** | .290** | .400** | 0.793 | - | - | - |

| Speed of Integration | .466** | .178** | .382** | .335** | .404** | 0.761 | - | - |

| Acculturation | .437** | .085 | .097* | .256** | .291** | .170** | 0.822 | - |

| Merger & Acquisition | .085 | .002 | .069 | .091* | .040 | .039 | .154** | 0.756 |

| **. Correlation is significant at the 0.01 level (2-tailed). Items in italics represent the square root of AVE | ||||||||

| Constructs | Co-efficient of Regression | ||

| T-statistics | P Values | Results | |

Internal Communication

Merger & Acquisition Merger & Acquisition |

2.105 | 0.036 | H1: Supported |

Work culture support

Merger & Acquisition Merger & Acquisition |

3.417 | 0.001 | H2: Supported |

work engagement

Merger & Acquisition Merger & Acquisition |

5.114 | 0.000 | H3: Supported |

Role clarity

Merger & Acquisition Merger & Acquisition |

4.042 | 0.000 | H4: Supported |

Innovative and risk-taking attitude

Merger & Acquisition Merger & Acquisition |

1.082 | 0.280 | H5: Not Supported |

Speed of integration

Merger & Acquisition Merger & Acquisition |

3.508 | 0.000 | H6: Supported |

| AC as Mediator | Direct Effect (t-value) | Indirect Effect (t-value) | Total Effect | VAF % | Effect | Results |

IC

AC AC

MA MA |

0.099 [2.105] | 0.135 [5.440] | 0.233 | 57.93% | Partial Mediation | H7-a, Supported |

WCS

AC AC

MA MA |

0.107 [2.944] | 0.062 [3.286] | 0.169 | 36.68% | Partial Mediation | H7-b Supported |

WE

AC AC

MA MA |

0.219 [5.142] | 0.142 [5.463] | 0.361 | 39.33% | Partial Mediation | H7-c Supported |

RC

AC AC

MA MA |

0.162 [2.108] | 0.061 [1.961] | 0.202 | 45.04% | Partial Mediation | H7-d Supported |

IRA

AC AC

MA MA |

0.052 [1.082] | 0.118 [3.960] | 0.160 | 73.75% | Indirect Mediation | H7-e Supported |

SI

AC AC

MA MA |

0.061 [0.947] | 0.050 [1.765] | 0.111 | 49.05% | Partial Mediation | H7-f Supported |

20% ≤ VAF ≥ 80% shows partial mediation.

7. DISCUSSION

The core intention of the research paper was to examine the association between newcomer employees' behavior and the performance of M&A during the post-merger phase in the Indian Banking context. The results show that five independent factors related to newcomers' employee behavior, such as Internal Communication (IC), Work Culture Support (WCS), Work Engagement (WE), Role clarity (RC), and Speed of integration (SI), have a direct and significant association with the performance of mergers and acquisitions. On the other hand, the independent variable, i.e., IRA, has no direct relationship with the performance of M&A. On the other hand, the variable innovation and risk-taking attitude have a feeble direct association with the performance of M&A. IRA was found to have an insignificant contribution that does not stimulate the performance of M&A in the Indian banking concept and did not support the hypothesis. This suggests that IRA requires combined faith, objectivity, and open-mindedness among employees and between employers and employees. It showed that there is a complex and idiosyncratic relationship between culture and innovation. High acculturation discourages organizations from risk-taking activities.

The outcomes of the present study are uniform and supported by the earlier research conducted. The results regarding internal communication are reliable to the studies conducted earlier that to enhance the post-M&A performance, the employees should know the vision and mission of the new entity [86]. The findings of work culture support are also consistent with previous studies on-boarding practices increase the pace of socialization among newcomers and provide a good range of benefits to the organizations. This demonstrates that individuals offer worth to the guidance got from their social group, associate, and companions who might be their assessment chiefs. The findings of work engagement were also found significant, indicating its significance for the performance of M&A. It has been examined that acculturation evolves along with the company’s lifecycle and is persuaded by shared learning [86, 87]. Organizational competitiveness is linked with the organizational culture [88]. Yet there are many other previous studies whose research did not support it and highlighted that the form of the rewarding system can also become the cause of mismatch in the performance of M&A and form a base for incompatibility and disengagement [89]. The findings of role clarity were also significant. It provides a sense of security among employees, and by generating a deep understanding of the surrounding environment in a particular culture, the employee feels a part of the company’s traditions and culture. Having an individual identity in the organization, employees learn how to do the assigned task in a well & organized manner and become successful. The well-defined environment clears the role assignment and behavioral guidelines among employees. Good compatibility in the organizational culture makes the effective integration process between two merged entities [90]. The type of integration between the acquirer and acquired banks is also associated with the value of speed. If there is high internal relatedness among employees in the form of strategic orientation and management style, then the speed of integration is beneficial [91]. Speed of integration benefits by giving competitors the less ideal opportunity to react, preventing post-acquisition phase drift, decreasing degrees of vulnerability, improving employee withholding level, and accomplishing quicker monetary returns [89, 92].

Acculturation does not impact only newcomers but also the dominant group or host that may result from subsequent relational outcomes from this interactive acculturation [90, 93]. To lessen the adverse consequence of acculturation, the component of mutual understanding nourished the culture of both companies sensibly.

M&A and the increasingly diverse workforce require employees to develop cultural sensitivity to succeed in various work settings. Innovative workers encourage new ideas that contradict their coworkers' conventional ways of doing things. As a result, workplace conflict and resistance in the form of creative employees clashing with their coworkers are likely to occur in the organization [89, 94]. The results demonstrate that cultural intelligence can significantly influence an employee's capacity for innovation at work. Acculturation mediates employees' capacity for taking risks and innovative work behavior through interpersonal trust and works engagement.

CONCLUSION AND IMPLICATIONS

Banks are adopting M&A strategies to maintain a competitive advantage in the dynamic environment. After reviewing the post-merger evidence, it has been seen that proper culture assessment and management of HR are still neglected. “HR can make or break the M&A” that will result in an unsuccessful merger in the banking sector. The present work shows the behavioral aspects of newcomer employees and their sense of coherence towards the successful integration of organizational cultures in merged banking entities. Cultural integration is not only essential for the performance of M&A but also enhances the growth & development of employees. The success of a merger lies in how well the cultural differences are assessed and integrated. The management of human capital is not an easy issue. Employees spend most of their hours in their working place, manager's guidelines may make it easier to give the right directions to the employees to focus and channel their energy in the process of cultural integration by developing a quality relationship with peers and adopting the new organizational culture, and values in a positive way. The current investigation has made a significant commitment to the existing literature on changing the board by and large and preparing to modify it at the individual stage, specifically by affixing applicable and significant settings at the post-merger stage.

LIMITATION AND FUTURE RESEARCH

Like other studies, the researcher also recognizes a few limitations in this study. Firstly, the current study considers the bank branches of only four merged public sector banks that experienced M&A on 1st April 2020 and are situated in the northern state. This indicates a limited scope of the research. Secondly, the study used a small sample size. To validate the findings, future research should increase the sample size. The future researcher should conduct exploratory research and consider the representatives of both acquirers and acquired firms to examine the culture compatibility at the employees and organizational level. Thirdly, the study was conducted on cross-sectional data to examine the behavior of newcomer employees on various constructs. The research should also be adopted a longitudinal research approach on the same employees to check the effect of various constructs over a while. Fourthly, the present research use acculturation to check the efficacy of the performance of M&A. To measure the effect of change on newcomer employees' behavior, future study could also consider the appropriate result-based management. The collection of data is a further limitation. Since the data was collected through self-reporting, there may be a problem with common method bias. To examine the impact of CMB, the researcher used statistical control techniques (factor analysis) and discovered that the data set was free of any common method bias problems. Lastly, further studies can also incorporate the private sector banks as the strategy of M&A is getting increasingly more received in private sector banks too.

LIST OF ABBREVIATIONS

| M&A | = Mergers & Acquisitions |

| BMB | = Bharatiya Mahila Bank Ltd. |

| SBI | = State Bank of India |

| BOB | = Bank of Baroda |

ETHICS APPROVAL AND CONSENT TO PARTICIPATE

Not applicable.

HUMAN AND ANIMAL RIGHTS

Not applicable

CONSENT FOR PUBLICATION

Informed consent was obtained from the participants.

STANDARDS OF REPORTING

STROBE guidelines were followed.

AVAILABILITY OF DATA AND MATERIALS

The datasets generated or analysed during the current study are not publicly available due to the collection of primary data.

FUNDING

None

CONFLICT OF INTEREST

Dr. Amit Mittal is the Associate Editorial Board Member of The Open Psychology Journal.

ACKNOWLEDGEMENTS

Declared none.

| Scale | Code | Item | Source |

|---|---|---|---|

| Internal Communication | IC1 | Shared information timely with all employees | Chatterjee et al. (1992) (three items) |

| IC2 | Build trust and develop motivation | ||

| IC3 | Inform vision, mission, and values of the new entity | ||

| Work Culture Support | WCS1 | Management provides support and warmth to the employees below them | Chatterjee et al. (1992) (six items) |

| WCS2 | Create and maintain effective communication and cooperation with peers | ||

| WCS3 | Helps to create Bonding Rituals | ||

| WCS4 | Make efforts to understand each other's problems and difficulties | ||

| WCS5 | Promotions are highly associated with excellent job performance | ||

| WCS6 | Encouraged to expose conflicts and to seek ways to resolve them | ||

| Work Engagement | WE1 | Time flies when I am working | Schaufeli, Bakker and Salanova (2006) (Five items) |

| WE2 | My job inspires me | ||

| WE3 | I am enthusiastic about my job | ||

| WE4 | I always appreciated good ideas | ||

| WE5 | At my work, I always persevere, even when things do not go well | ||

| Role Clarity | RC1 | I know my role as an employee in the organization | Mukherjee, A., & Malhotra, N. (2006), (four items) |

| RC2 | Decision-making should be made clear to all employees | ||

| RC3 | Responsibility for decisions should be communicated | ||

| RC4 | I know the limits of my present job | ||

| Innovative and Risk-taking Attitude | IRA 1 | I am innovative rather than conservative in decision making | Chatterjee et al. (1992) (three items) |

| IRA2 | I am innovative, take independent actions and reasonable risks | ||

| IRA3 | Risk is calculated by me at the right time | ||

| Speed of Integration | SI1 | usually used the word “we” rather than “they when talking about an organization that I work for | Homburg and Bucerius (2006) (Three items) |

| SI2 | Use of the phrases “best of both” or “best practices” | ||

| SI3 | Without an organization to work for, I would feel incomplete. | ||

| Acculturation | AC1 | I keep up-to-date professional knowledge and skills | (Edmondson, 1999) (Three items) |

| AC2 | I come up with creative solutions to new problems | ||

| AC3 | I am open-minded and curious to adopt the new culture | ||

| Performance of M&A | MA1 | Influence of the merger on the improving Revenue growth | Homburg and Bucerius (2006) (three items) |

| MA2 | Influence of the merger on the total acquirer performance | ||

| MA3 | Influence of the merger on the improvement of the service quality |